Getty images

At CapSens, we worked for several investment funds including Idinvest, famous for funding startups (Meero, Payfit, October,…), INCO, famous for funding social business startups (Simplon, LITA.co, ETIC,…) or French banks (Société Générale, Arkéa, Caisse d'Épargne, etc.)

These structures, founded about twenty years ago on average, work a lot on their network to identify the targets for their funding.

Kima Ventures has thus removed the “apply” page from its website.

The importance given to the employees of the structure rather than to the procedures or the need to position themselves quickly on a deal are all reasons why investment funds have not invested their own digitization. Indeed, it is complex to digitize a structure with little process.

However, three factors are currently pushing them to automate processes using digital tools:

The funds grew, reaching a size that required more rigorous processes,

Competition has increased. Eldorado now has 400 investment funds in France,

The regulation is more restrictive concerning investors (for funds that collect from the "general public"): information obligation, classification of investors, FATCA, etc.

We understand, going digital "does not mean using digital tools" but using them at scale and strategically. Because simply sharing your data on Dropbox, communicating with Slack and monitoring your CRM on Google Doc is not a good use of digital with 5 employees.

Here are the various elements on which we are seeing major digitization efforts and on which we are working at CapSens: firstly, we present here the elements related to the dealflow and secondly those related to the investor relationship.

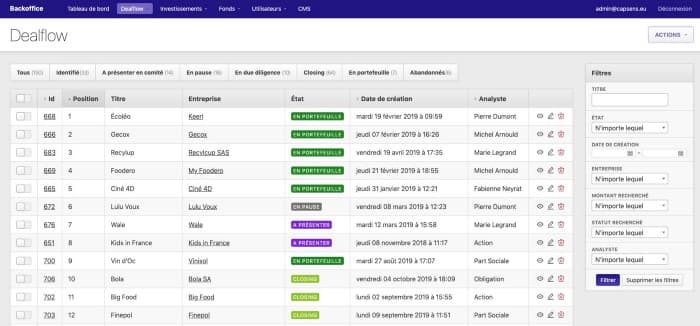

Dealflow and portfolio monitoring

In a fund, analysts meet entrepreneurs, follow them from project to project, do not review them for several months, collect a lot of information, and have to coordinate within their structure.Many funds use a shared Excel spreadsheet to follow this with columnar fields such as:

Concerning the company: Company name, address, name of the manager, development phase (start-up, acceleration, development), date of creation, legal status, SIRET, NAF code, sectors of activity, indicators, activity, telephone, contact, email, website, business provider, turnover, feedback, number of employees, etc.

Concerning the upcoming investment in the company: state of the investment (identified, to be presented to the committee, on break, due diligence, closing in progress, closing on hold, in the portfolio, abandoned with the reasons for abandonment) , total amount sought (or raised), amount for the fund, probability of realization, type of financial instrument (Shares, BSA, bonds, etc.), Bpifrance guarantee, guarantee date, other guarantees, date of investment, amount actually invested, etc.

These Excels (or Google Sheets) are very practical because they are flexible: it is easy to add calculations and columns to them, however this poses a lot of problems at scale: duplication and dated versions, overwriting of formulas, modification of the template by employees, forgetting to provide information, lack of automated actions. Here is what you can do simply by developing your own tool. CRMs are not flexible enough to achieve this:

Each user has an account, which makes it possible to track actions, give differentiated rights according to the type of user and assign files.

Analysts receive configurable automatic emails. It can be reminders (when a company has been “on hiatus” for more than 2 months), reports (every Monday I receive a summary of the changes made last week), notifications (such company that you follow has been switched to due diligence by such user).

Connection to external APIs: Google maps, Salesforce, Airtable, Infogreffe,… to send information or retrieve it automatically.

Monitoring of quarterly figures for portfolio companies.

Exports: of course Excel exports are always possible just in case, but also exports formatted in PDF for reports.

Third party access: give access to the chartered accountant, or to investors. They will only see what you want them to see: a selection of data or a summary.

Data visualization consists in communicating figures or raw information by transforming them into visual objects: diagrams, diagrams.

KYC and online subscription

In view of the high amounts of subscriptions accepted (€ 20,000 for the smallest tickets for some VC funds and several million for others) the funds have long preferred to manage investments manually.

If he puts in € 500k, we can talk to him for 30 minutes on the phone to help him.

This assertion is completely false because:

An investor doesn't necessarily like taking 30 minutes to talk about ID and checkboxes on a form. He will prefer to do this online if it is done right.

As complex as the regulation may seem, it can be integrated into a platform with conditions that only apply in the right cases. And that's a lot of time saved for the fund.

Better to spend 30 minutes on the phone defending your investment strategy and talking about track records or the history of a fund than talking about "Form W-8BEN-E".

Here's what you can do just by developing your own tool:

Subscribe investors (natural and legal persons) online by starting by asking them for identity information, family situation, FATCA, professional situation, financial profile, financial situation and knowledge as well as investment objectives .

Make conditional fields: if he says he is married the form adds the question of the matrimonial regime and if he says “Universal community” or “Community reduced to acquaintances” the form will ask for the spouse's profession. It is possible to go further to combine income, assets and the amount that the investor wishes to invest.

Block or correct incorrect answers directly rather than receiving incorrectly completed forms.

From the filled in fields automatically generate a subscription form ready to sign. This is signed online via a service such as Universign by an SMS sent to the subscriber.

The subscriber does not have to fill in their personal information again and upload their supporting documents for future subscriptions. In addition, it can find online its history, signed documents etc.

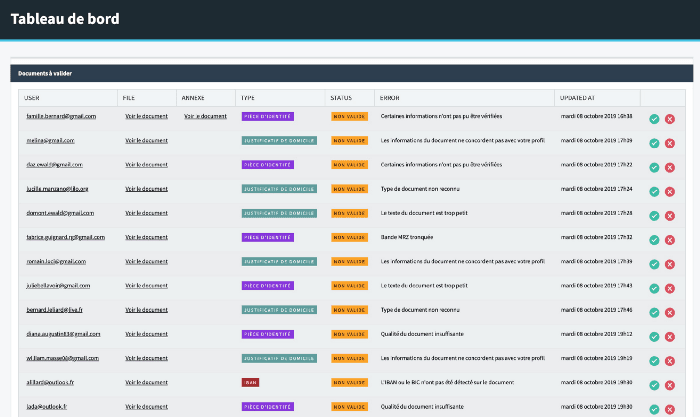

In the back office, files are classified according to their state of progress.

Automated part control via Automatic Image Reading (OCR) by Netheos PreventGo API for example.

Automatic reconciliation of transfers received after call for funds.

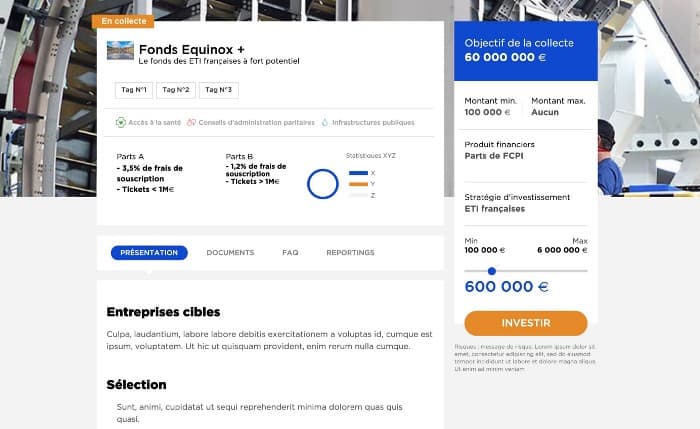

Investor performance monitoring portal

Here too, it is about saving time for the fund teams (“client servicing”, “sales”, etc.) so that they spend time on what is of value. We are developing portals so that investors can find:

Past performance depending on the type of units held by the investor. Connection with Morningstar to retrieve data and notes.

Investment and fundraising simulations, from N to N + 10, by simulating what the current funds in the portfolio will call and distribute in the future.

Database gathering all the documents relating to investors and their investments: annual accounts, reports, fund regulations, prospectuses, subscription forms, notices of fundraising and distribution, capital account statements, annual fund accounts , etc.

Wealth Management Advisors Portal (PMC)

Entangled in increasingly time-consuming regulations, CGPs appreciate the tools that facilitate their work. Here is what can be implemented so that they subscribe their clients to the funds:

Access to CGP for the KYC tool and online subscription. Thus the CGP, in the presence of his client, fills in all the information of his client from his online space.

Monitoring of customer subscriptions and monitoring of commissions and their payment by the fund.

View of funds for which the CGP does not have a distribution agreement and the possibility of requesting them.

The CGP firms distribute the subscriptions among the advisers.

Access to heritage simulation tools.

Special tablet format and offline access to some of the portal's functionalities.

It is important to understand that we make all these tools to measure according to the needs of our customers, because they are all particular. However, we create and use "bricks" of code (called "gem" in Ruby) which allow us to speed up developments and limit technical risk. For more information: nicolas@capsens.eu

New Slack integration service with Qonto